Embracing the Edge: The Power of Taking Calculated Risks as an Investor

In the realm of investing, risk and reward go hand in hand. While the word "risk" often invokes a sense of caution, wise investors understand that calculated risks can be the catalyst for extraordinary success. In this blog post, we explore the art of taking risks and how embracing them can set you apart as an investor. Buckle up and get ready to discover why stepping out of your comfort zone might be the best move you'll ever make.

The path to exceptional returns often lies outside the realm of the familiar. Successful investors recognize that taking calculated risks means venturing into uncharted territory. It means seeking opportunities where others see uncertainty. By stepping outside their comfort zones, investors expose themselves to the potential for extraordinary gains that can transform their portfolios. Embracing the unknown becomes a mindset that fuels innovation, adaptability, and the ability to spot opportunities that others overlook.

Investing inherently involves the risk-return tradeoff. Higher returns usually accompany higher risks, and vice versa. While some may shy away from risk, savvy investors understand that a well-balanced portfolio requires a strategic mix of investments with varying levels of risk. By carefully assessing and managing risks, investors can create a diversified portfolio that mitigates potential losses while maximizing potential gains. It's all about finding the sweet spot where risk and reward align, and being willing to seize the opportunities that come with it.

Taking risks inevitably means that not every investment will yield the desired outcome. However, failure should not be seen as a setback but as an opportunity for growth. Experienced investors know that failure provides invaluable lessons and insights. It fuels resilience, adaptability, and a deeper understanding of the market. By embracing failure and learning from it, investors can refine their strategies, fine-tune their decision-making processes, and ultimately increase their chances of long-term success.

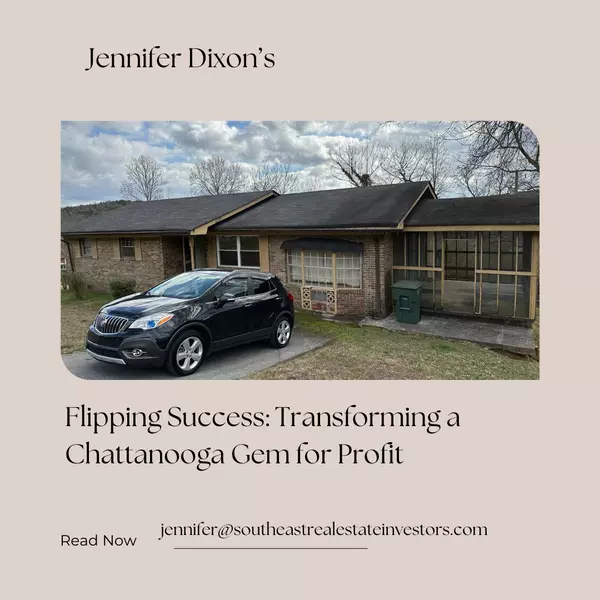

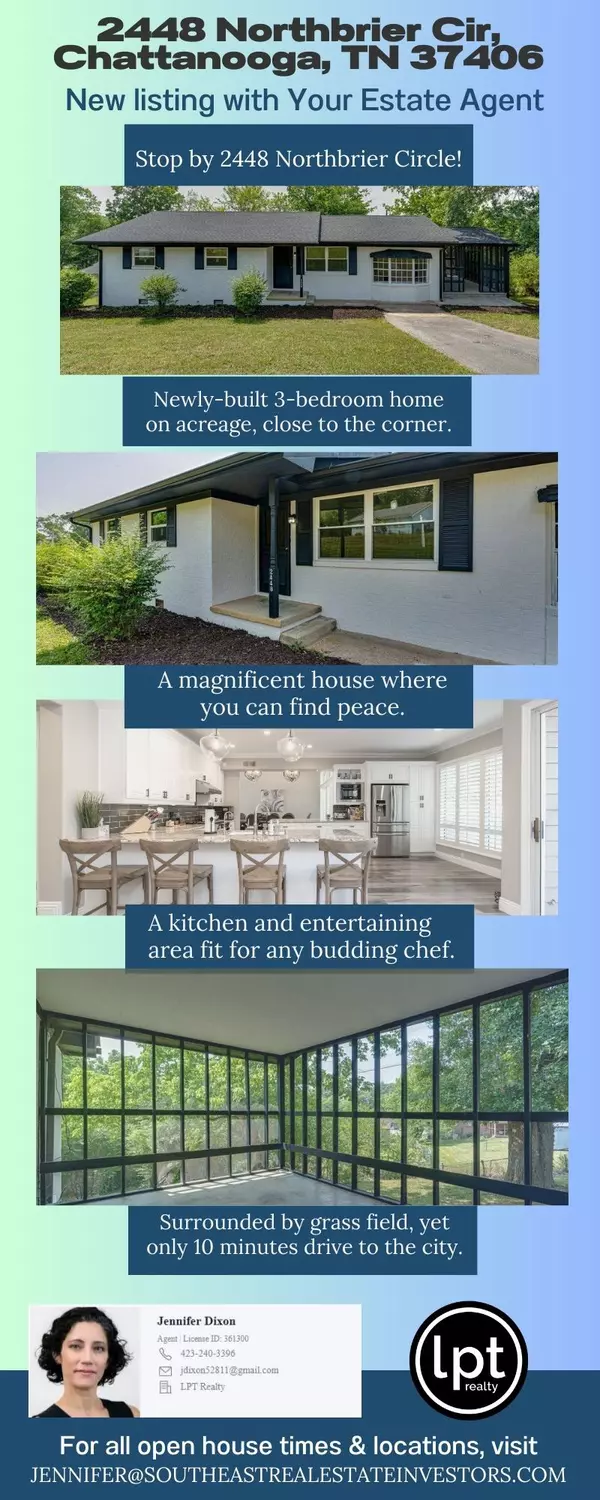

Great investors are not afraid to blaze their own trails. They understand that following the herd rarely leads to exceptional results. Instead, they have the courage to deviate from conventional wisdom and explore unconventional opportunities. By seeking out undiscovered gems, niches, and emerging trends, investors can position themselves ahead of the curve, unlocking significant potential and gaining a competitive edge. The road less traveled may be riskier, but it is often where the greatest rewards lie.

In the thrilling world of investing, taking calculated risks is not just beneficial; it is essential. It is the key that unlocks doors to exceptional returns and propels investors to new heights. By embracing the unknown, navigating the risk-return tradeoff, learning from failure, and venturing off the beaten path, investors can position themselves for success. So, dare to take risks, trust your instincts, and let your investment journey be marked by audacity and the pursuit of greatness. Remember, the greatest achievements often come to those who are willing to embrace the edge.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "