Understanding the Recent Federal Interest Rate Hike and Its Impact on Mortgage Prices

The Federal Reserve recently announced an interest rate hike, which has led many to wonder about its impact on mortgage prices. While it may seem counterintuitive, an interest rate hike can actually sometimes lead to a reduction in mortgage prices. In this post, we'll explore why this happens and what it means for homeowners and prospective homebuyers.

First, let's talk about the Federal Reserve's decision to raise interest rates. The Fed's primary goal is to maintain stable prices and promote maximum employment. One way it does this is by adjusting the federal funds rate, which is the interest rate that banks charge each other for overnight loans. When the Fed raises the federal funds rate, it makes it more expensive for banks to borrow money. Banks then pass on this increased cost to consumers in the form of higher interest rates on loans and credit cards.

Now, you might be wondering why an interest rate hike would lead to a reduction in mortgage prices. The answer lies in the way that mortgage rates are determined. Mortgage rates are influenced by a variety of factors, including the yield on the 10-year Treasury note, the state of the economy, and investor demand for mortgage-backed securities. When the Fed raises interest rates, it can cause the yield on the 10-year Treasury note to fall. This is because investors may see Treasury bonds as a more attractive investment than riskier assets like stocks. When the yield on the 10-year Treasury note falls, so do mortgage rates.

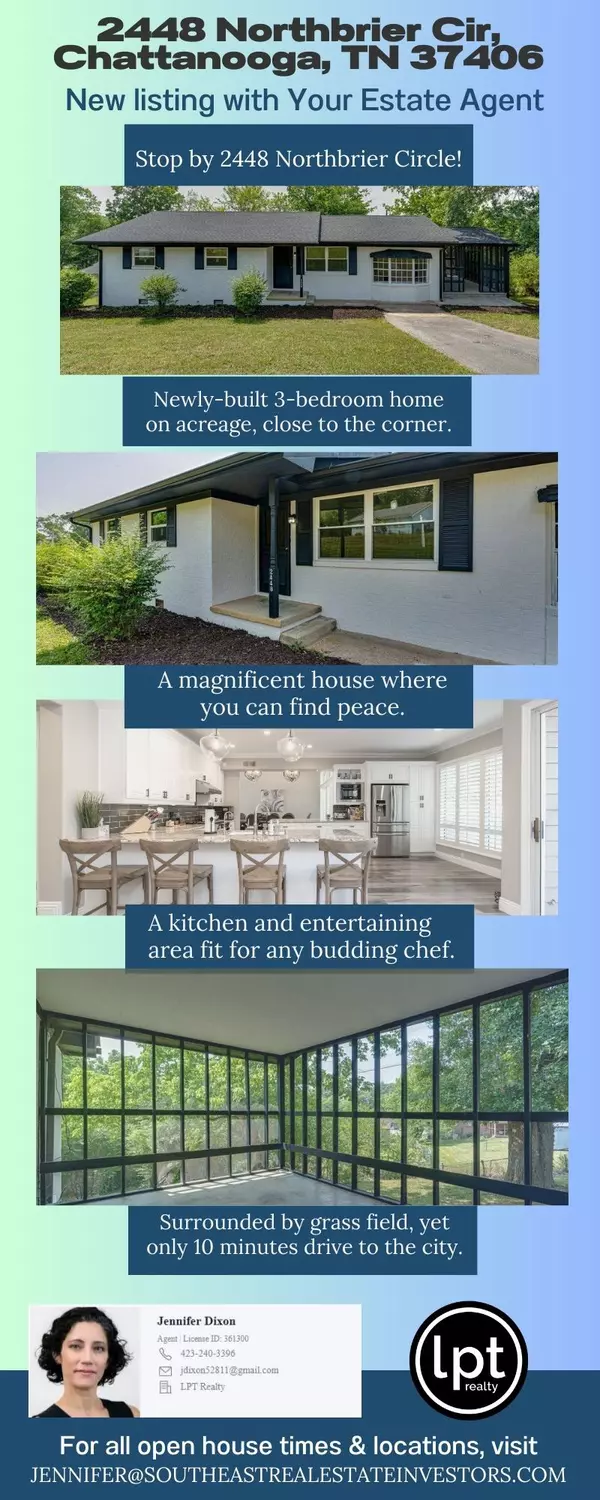

So, what does this mean for homeowners and prospective homebuyers? If you have been on the fence about buying, now may be a great time to make that move! Or, if you were one of the few Americans that did NOT take advantage of our historically low interest rates of the prior few Pandemic years, you may be able to refinance at a lower rate, which could save you thousands of dollars in interest payments over the life of your loan. Keep in mind that refinancing typically involves upfront costs, so you'll want to do the math to make sure it makes financial sense for you.

If you're in the market for a new home, this lowered mortgage rate could make homeownership more affordable. Lower mortgage rates mean lower monthly payments, which can make a big difference in your budget. However, keep in mind that home prices may also be influenced by the state of the economy, so it's important to do your research and make sure you're getting a fair price.

In conclusion, the recent federal interest rate hike may seem like bad news for borrowers, but it could actually lead to a reduction in mortgage prices. By understanding how the Fed's actions affect mortgage rates, you can make informed decisions about your finances and take advantage of lower rates to save money on your mortgage.

If you would like to learn more, don't hesitate to reach out to an experienced, investor friendly agent like me, Jennifer Dixon! I cover the Greater Chattanooga, TN area including North Georgia.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "